The value of the insurance must be compared to the chance of submitting a claim to the company. Pet insurance, like human health insurance, works best to cover unexpected and expensive situations. If your pet ends up hospitalized with a serious illness. Coverage will be a godsend and can save you hundreds, if not thousands, of dollars. In this article, I try to explain How Does Pet Insurance Work. Pet health insurance is inexpensive compared to human health insurance.

There are two basic kinds of health plans. First, like human insurance plans. There are companies that pay a percentage of the charges after you pay a deductible first. Second, there are price-reduction plans that, for an annual fee, cover a small percentage of virtually any pet-related charges. Usually, the smaller the deductible, the higher the premium. As with human health insurance, the more expensive plans have higher limits.

Pet insurance offers high-quality veterinary medicines and expensive treatment to all dogs or Cate (Pet) owners. Since pet care can quickly get expensive, insurance can help alleviate the financial burden. So owners and veterinarians can make healthcare decisions for pets based on the best medical care options rather than on monetary worries.

Is Pet insurance Worth The Price?

Unlike human health insurance plans, though, pet insurance plans may have age restrictions. There are limits to what a company will pay. Compared to human insurance, which offers a lifetime maximum of around $3 million, pet insurance offers a lifetime maximum of approximately $150,000. There are per-incident limits and annual limits to what a company will pay out.

There is also pet life insurance, just like for people. Where you pay a monthly or yearly premium in exchange for receiving a lump sum of money when your pet dies. An accidental death policy if your pet should meet with an untimely death. Some of these policies include bereavement counseling for the pet owner. Pet travel insurance is also available. Which offers policies to pet owners for unexpected travel-related expenses for their pets. Even if the pets are left at home.

Pet Insurance, How It All Started?

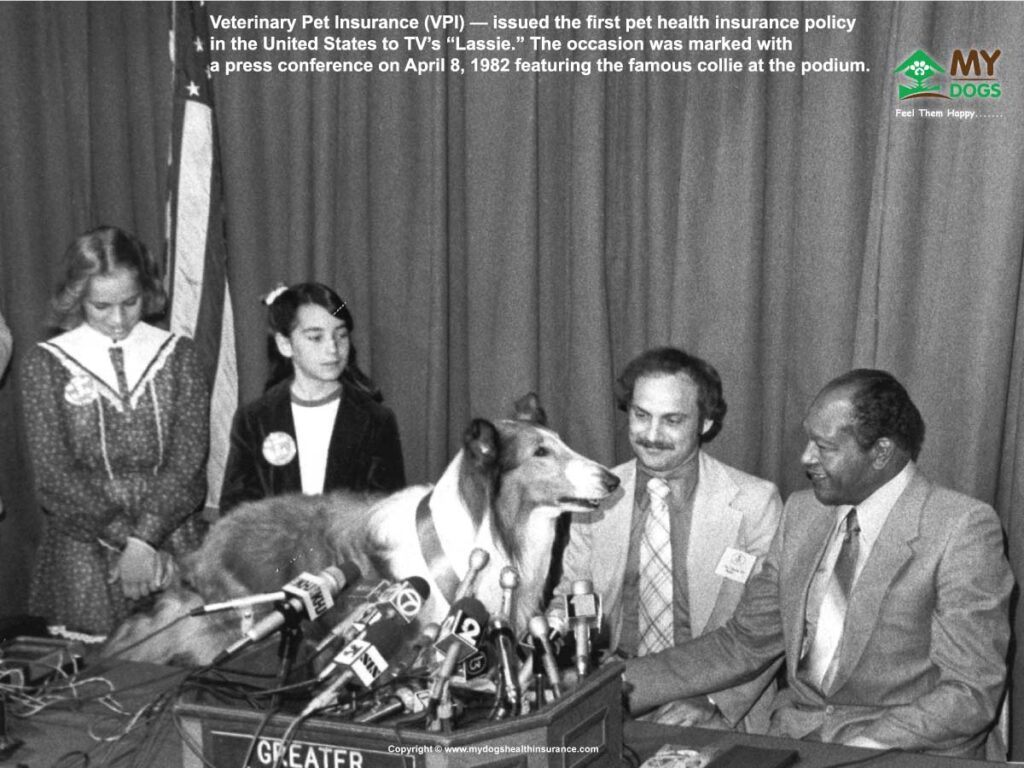

Nationwide pet insurance became available in the United States in 1982 with the formation of Veterinary Pet Insurance. Still the largest pet insurance company in the country. About thirty different pet insurers came and went between 1982 and 1998. Today there are only a handful of insurance companies in the United States. Providing coverage to less than 0.5 percent of the pet population.

Fortunately for many pets, pet insurance is catching on in the United States, and there are several different pet insurance companies. Each offers numerous types of policies with varying degrees of coverage. Although only a small number of companies market nationwide plans. Analysts predict an expansion of the industry in the next several years.

To Insure or Not to Insure

- What do you think the odds are that your pet will have an accident or become ill?

- You need to carefully analyze your pet’s lifestyle.

- Does it often get into fights with other dogs or cats, get into the garbage, have a tendency to eat nonfood items, or have a pet’s family history of hip dysplasia, diabetes, or some other genetically predisposed condition?

- When it comes to pet insurance, you can’t decide on price alone, so arm yourself with the knowledge to secure the insurance policy that’s best for you and your pet.

- I recommend that you add up how much you spend a year on veterinary care for cash pet and separate the costs into routine care versus accidents and/or illness.

- Create projections for the next one to five years, and then calculate the cost of the premium for that time period and the percentage of your spending that the pet insurance policy would cover.

- You also need to consider the age of your dog and its potential to have health problems. Initially, monthly premiums frequently correspond to greater deductibles and/or co-payments.

Routine Care Coverage in Pet Insurance

Routine care includes all those treatments and vet visits that you bring your pet in for every year to promote its health, including annual checkups, vaccinations, and sometimes spaying or neutering. The benefits for routine coverage include not having to worry about what’s covered. Everything is basically covered, so all you have to do is send in the itemized bills.

On the other hand. Many pet owners feel pet insurance should be for expenses that are unexpected. Not for routine vet visits. Since premiums have to cover the cost of claims and other expenses such as sale commissions and administrative costs, you’ll pay more for a routine visit if insurance covers it than if you just pay out of pocket.

Where does pet insurance come in?

Purchasing health insurance for your cat or dog is one method to avoid having to decide between them and your wallet during a medical emergency. How Does Pet Insurance Work, Too frequently, pet owners are forced to choose between paying for an exorbitantly expensive medical operation and financial euthanasia.

Family members may feel torn, guilty, resentful, or devastated after making such a difficult decision to end their pet’s life. Many pet owners who might not otherwise be able to afford it can receive cutting-edge medical care and/or traumatic emergency care thanks to pet insurance, which significantly reduces financial euthanasia.

United States (USA) Pet Insurance Market Growth

Total pet insurance market revenue in the United States has skyrocketed during the past ten years, increasing 342 percent from 1998 to 2002, with sales of approximately $88 million in 2002 according to market trends. The $200-million market for pet insurance is expected to grow at forty percent per year, reaching $667 million by 2007.

However, concerned authorities Estimated the size of the United States (USA) Pet Insurance Market at USD 1.94 billion in 2021. Additionally, BlueWeave projects that the US pet insurance market would grow at a double-digit CAGR of 10.6% from 2022 to 2028, reaching a value of USD 3.85 billion. Increased pet ownership, the need to reduce financial risk, and the high cost of veterinary care are the main growth drivers for the US pet insurance market. How Does Pet Insurance Work, according to the American Society for the Prevention of Cruelty to Animals, up to 6.5 million companion animals enter animal shelters in the United States each year. Most of those pets are dogs, With over 3.3 million dogs. Some analysts believe that in fifty years, pet health insurance will be universal in this country.

Today, pet insurance is widely requested three percent of North American companies currently offer it as a voluntary benefit, and although fewer. The number is growing. Employers that offer pet insurance include the State of California, the State of Delaware, the University of Ohio Alumni Association, Mercy Hospital in Florida, and The Gap in Canada. Some insurance companies have teamed up with companies like Petco and the American Kennel Club to offer coverage. You have a wide range of options for pet insurance.

Conclusion

While some plans just cover accidents and illnesses, others cover all medical costs, including yearly checkups and vaccinations. For recently adopted animals as well as more elderly animals, there is even a shelter plan. Most plans let you to select your own veterinarian, and other policies give discounts for several pets. Average premiums range from $120 to S500 per year, depending on your plan. How Does Pet Insurance Work, working for a firm that includes pet insurance as part of its benefits package is another method to get pet insurance besides purchasing it straight from the provider since some businesses now give employees the chance to get insurance for their pets at a reduced price. Formerly unheard of, this is now more common as employers realize how important pets are to people’s life.

Note: You can Submit Your application for Pet Insurance Quote Here.